Analysis of the Big Bullshit Bill (H.R. 1)

Who are the Winners and Losers?

The Senate version of Trump and MAGA’s Big Bullshit Bill is 870 pages and filled with billionaire benefits and targeted attacks at Democrats and the poor. No one can read and analyze the whole thing in a day or two, so I asked Google’s Gemini AI to look at the bill and identify winners and losers. This post is long, but it includes most of the winners and losers. Please share it widely and call your U.S. House representative (202-224-3121) and tell them to vote no on this atrocity!

My commentary is added in block quotes like this.

Summary of Findings

The bill appears to be a broad legislative effort that prioritizes certain economic interests, defense spending, and stricter immigration enforcement, at the expense of social welfare programs, environmental protection, and certain categories of individuals. While some provisions offer broad tax relief, others impose new restrictions and fees that could disproportionately affect vulnerable populations like the poor, the disabled, and children.

1. Costs and Rewards for Different Groups

High-Income Earners and Large Estates (Winners):

The bill includes an "extension and enhancement of increased estate and gift tax exemption amounts", meaning more wealth can be transferred without incurring taxes, benefiting affluent families.

"Extension and enhancement of increased alternative minimum tax exemption amounts and modification of phaseout thresholds" also primarily benefits higher earners by reducing their alternative minimum tax liability.

"Limitation on individual deductions for certain state and local taxes, etc." This section is framed as a limitation, but the specifics would need further analysis to determine the precise impact on individuals, as often such limitations can disproportionately affect residents of high-tax states.

Millionaires and billionaires are the big winners in this bill. Because they, you know, need more money.

Agricultural Sector (Mixed Impact):

Farmers/Producers: Potential winners through extensions and modifications of price loss coverage, agriculture risk coverage, marketing loans, and supplemental agricultural disaster assistance, which could stabilize or increase their income. The bill extends certain crop insurance provisions, including a "beginning farmer and rancher benefit".

Textile Mills: Explicitly benefit from economic adjustment assistance, which continues through July 31, 2032.

Sugar and Dairy Industries: Receive updates to their respective programs.

The vast majority of the “agricultural sector” is comprised of giant corporate farms who are the winners.

Defense and Military Contractors (Winners):

The bill allocates significant enhancements to Department of Defense resources across numerous areas, including improving the quality of life for military personnel, shipbuilding, integrated air and missile defense, munitions and defense supply chain resiliency, scaling low-cost weapons, efficiency and cybersecurity, air superiority, nuclear forces, Indo-Pacific Command capabilities, and readiness. This translates into increased funding and potential contracts for defense industries and improved conditions for military personnel.

Corporate defense companies and their shareholders win big although none of this funding goes to support Ukraine in their defense of democracy against the Putin and his Russian invaders.

Oil, Gas, and Mining Industries (Winners):

The bill promotes "America-First Energy Policy" through various provisions, including:

Enhanced onshore and offshore oil and gas leasing.

Modifications related to royalties on extracted methane, potentially reducing costs for producers.

Provisions for coal leasing and royalties that could favor the coal industry.

Extension and modification of the clean fuel production credit.

Allowing intangible drilling and development costs to be taken into account for adjusted financial statement income.

Adding income from hydrogen storage, carbon capture, advanced nuclear, hydropower, and geothermal energy to qualifying income of certain publicly traded partnerships.

"Energy dominance financing".

Massive amounts of money for oil and gas companies. Increased drilling and mining will cause enormous and permanent environmental damage and pollution which in turn leads to more cancer and illnesses for American citizens.

Businesses and Corporations (Winners):

"Middle-Class Tax Relief": The bill purports to provide "permanent tax relief for middle-class families and workers" through various extensions and enhancements of reduced rates, increased standard deduction, and increased child tax credit.

Small Businesses and Rural America: Expansion of qualified small business stock gain exclusion, repeal of revision to de minimis rules for third-party network transactions, increased threshold for information reporting, and exclusion of interest on loans secured by rural or agricultural real property.

Job Creators: Provisions like full expensing for certain business property and domestic research and experimental expenditures, modification of business interest limitation, increased dollar limitations for expensing, and special depreciation allowance for qualified production property are designed to benefit businesses by reducing their tax burden and encouraging investment.

Manufacturing: Enhancement of advanced manufacturing investment credit and restrictions on the extension of advanced energy project credit program could steer investment towards traditional manufacturing.

“Middle-class tax relief” sounds great on paper, but the bottom-line reality is not nearly as glowing. See the tax section below.

The other three bullets are once again giveaways to corporate America.

Certain Individuals and Families (Mixed Impact/Potential Winners):

Families with Children: Enhancement of employer-provided child care credit, adoption credit, and child and dependent care tax credit.

Students: Exclusion for employer payments of student loans and expanded qualified higher education expenses for 529 accounts. However, student loan limits are established for graduate and professional students, and graduate/professional PLUS loans are terminated, which could be a significant loss for many pursuing higher education.

Those with ABLE Accounts: Extension and enhancement of increased limitation on contributions to ABLE accounts and savers credit allowed for ABLE contributions.

People who dye fuel: The bill allows for payments to certain individuals who dye fuel.

The first bullet might translate into slightly more money in parents’ pockets through increased tax credits. The losers are people who want to go to college because the bill basically kills student loans so no one will be able to afford the (exorbitant) cost of college.

The “dye fuel” thing has to be some kind of pork to buy someone’s vote.

2. People Losing Benefits / Targeted Attacks

SNAP Recipients (Losers):

Sec. 10102. Modifications to SNAP work requirements for able-bodied adults: This section is highly likely to lead to a significant number of able-bodied adults losing SNAP benefits by imposing stricter work requirements. Without the specific details of the modifications, an exact number cannot be provided, but similar policy changes in the past have resulted in hundreds of thousands losing benefits.Sec. 10108. Alien SNAP eligibility: This explicitly targets non-citizens, likely leading to a reduction in SNAP eligibility for this group.Re-evaluation of Thrifty Food Plan (Potential Losers): The bill specifies that the Thrifty Food Plan, which determines SNAP allotments, "shall only be changed pursuant to paragraph (4)" and its cost "may only be adjusted in accordance with this subsection". This could limit future adjustments to reflect rising food costs or changing dietary needs, effectively reducing the real value of benefits over time for all SNAP households.

Work requirements are a “sounds reasonable” targeted way to kick people off of food benefits. The vast majority of “able-bodied adults” who receive SNAP want to work but can’t find a job, do not have transportation to a job, or have children or dependents to care for.

Under existing federal law (the Personal Responsibility and Work Opportunity Reconciliation Act of 1996) already bans federal public benefits like SNAP and Medicaid to illegal immigrants. Only "qualified aliens” (i.e., legitimate asylum seekers who are following the law) might be eligible. This section is a toothless MAGA propaganda attack and serves no legislative purpose.

The final bullet means that SNAP benefits will no longer keep up with Trump-caused inflation and more people will go hungry.

Medicaid Recipients (Losers / Targeted Attacks):

Sec. 71109. Alien Medicaid eligibility: This section explicitly targets non-citizens, making them ineligible or more difficult to enroll in Medicaid.Sec. 71119. Requirement for States to establish Medicaid community engagement requirements for certain individuals: This introduces work requirements for certain Medicaid recipients, similar to SNAP, which historically leads to many losing coverage due to inability to meet administrative burdens or find qualifying work.Sec. 71120. Modifying cost sharing requirements for certain expansion individuals under the Medicaid program: Increased cost-sharing can make healthcare unaffordable for low-income individuals, effectively reducing access to care and leading to disenrollment.Sec. 71107. Eligibility redeterminations: Increased frequency or stringency of eligibility redeterminations, combined withSec. 71103. Reducing duplicate enrollment under the Medicaid and CHIP programs, andSec. 71104. Ensuring deceased individuals do not remain enrolled, could lead to people losing coverage due to administrative hurdles, even if they are still eligible. The bill appropriates $10,000,000 for fiscal year 2026 and $20,000,000 for fiscal year 2029 for a system to prevent simultaneous enrollment in multiple state plans.Sec. 71108. Revising home equity limit for determining eligibility for long-term care services under the Medicaid program: This change could make it harder for seniors and individuals with disabilities to qualify for long-term care, potentially forcing them to spend down more assets or go without needed services.Prohibited Entities:

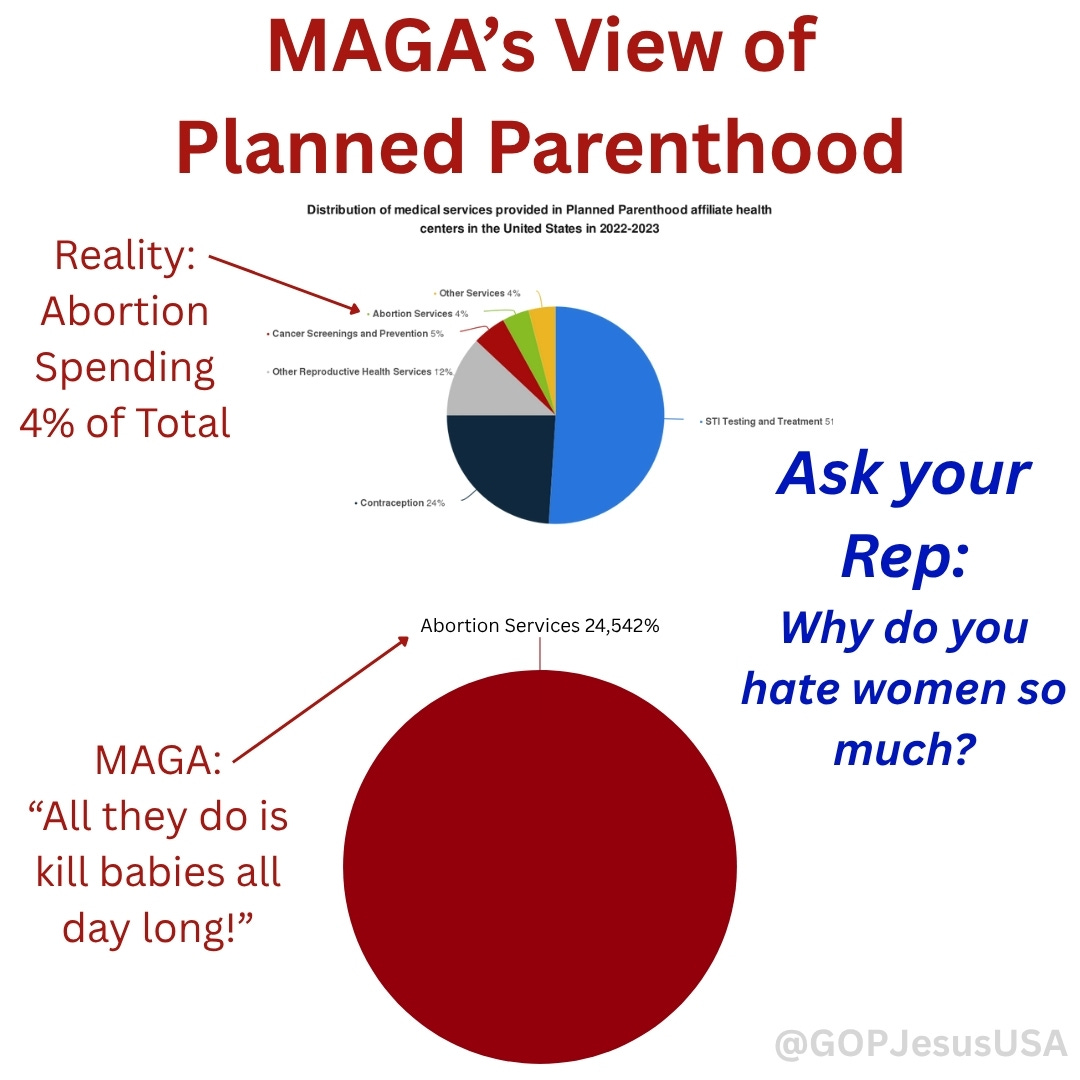

Sec. 71113. Federal payments to prohibited entitiescould be a targeted attack on organizations like Planned Parenthood by restricting federal payments, potentially limiting access to vital health services, especially for women in rural or underserved areas, as it may lead to the closure of clinics.Sec. 71111. Moratorium on implementation of rule relating to staffing standards for long-term care facilities under the Medicare and Medicaid programs: This moratorium could negatively impact the quality of care for residents in long-term care facilities by preventing the implementation of enhanced staffing standards.Much like with SNAP benefits, the ultimate goal is to kick as many Americans off of Medicaid as possible through “feel good” provisions like work requirements (see above under SNAP).

They are making it more burdensome to apply and maintain eligibility by doubling how often you have to re-qualify. If you have never applied for public benefits, it is mind-numbingly difficult to wade through the layers of forms and bureaucracy and many people make mistakes or miss a required checkbox or form and do not get deserved benefits.

By kicking over 8.6-17 million people off of Medicaid. Will that directly lead to more deaths?

A Yale/Penn study cited by multiple sources estimates that the Medicaid cuts could result in 51,000 preventable deaths annually nationwide, potentially making the bill a top ten cause of death in the U.S. This figure is based on historical data showing that for every 1,000 people on Medicaid, 1–4 lives are saved annually due to improved access to care. Saving people from literally dying seems like a good thing for our government to spend money on, doesn’t it? Don’t worry though, none of those 51,000 dead Americans will be relate to Donald Trump or any of the MAGA Congressmen or Senators who voted for this murderous bill.Loss of Medicaid coverage increases avoidable hospitalizations, emergency room visits, and untreated chronic conditions (e.g., diabetes, heart disease, cancer), leading to higher mortality. For example, reduced access to cancer screenings and treatments will disproportionately affect low-income populations.

The home equity provision is a targeted attack against high-home-price states like New York and California which are mostly Democratic. Many struggling people live in homes they inherited or which increased in value over the decades. MAGA would have people sell their homes to pay for food and health care.

The “prohibited entities” provision is a direct attack on Planned Parenthood, because the GOP hate women.

Medicare Recipients (Potential Losers):

Sec. 71201. Limiting Medicare coverage of certain individuals: This section could lead to some individuals losing Medicare coverage or having their coverage restricted.Trump and his MAGA acolytes are coming for your Medicare next. This provision is simply the the first sally against seniors. They want to set the stage and get people accustomed to the idea that Medicare cuts are not off the table.

Clean Energy and Environmental Protection Advocates/Industries (Losers / Targeted Attacks):

The bill includes numerous provisions to terminate or restrict tax credits and funding for clean energy initiatives, effectively ending "Green New Deal Spending". This directly impacts renewable energy companies, manufacturers of clean vehicles, and homeowners/businesses investing in energy efficiency. Specific terminations include:

Previously-owned clean vehicle credit.

Clean vehicle credit.

Qualified commercial clean vehicles credit.

Alternative fuel vehicle refueling property credit.

Energy efficient home improvement credit.

Residential clean energy credit.

Energy efficient commercial buildings deduction.

New energy efficient home credit.

Cost recovery for energy property.

Clean hydrogen production credit.

Clean electricity production and investment credits.

Phase-out and restrictions on advanced manufacturing production credit.

Restriction on the extension of advanced energy project credit program.

Significant rescissions of funding are directed at environmental protection programs under Title VI. This includes funding for clean heavy-duty vehicles, the Greenhouse Gas Reduction Fund, diesel emissions reductions, air pollution (general and at schools), low emissions electricity, Clean Air Act implementation, environmental product declaration assistance, methane emissions reduction, greenhouse gas air pollution plans, EPA reviews, low-embodied carbon labeling, environmental and climate justice block grants, ESA recovery plans, and environmental and climate data collection. These rescissions will hinder efforts to combat climate change and reduce pollution, potentially leading to worse public health outcomes and environmental degradation. The bill rescinds unobligated balances from sections of the Inflation Reduction Act of 2022.

The bill eliminates federal spending on green energy like solar and wind as well as most funding for environmental protection.

Combined with the huge giveaways to the oil and gas companies (see above) means the US will fall further behind countries like China which already generates more than 38% of its electricity from renewable sources vs. 22% in the U.S. China is a strategic political enemy of the United States so their growing power and economic dominance is a threat to U.S. security.

On pollution, if renewable growth slows by 20–30% (a conservative estimate based on stalled projects from the elimination of tax credits in Biden’s Inflation Reduction Act), and fossil fuels fill the gap, emissions could increase by 100–200 million metric tons of CO₂ annually by 2030.

The bill’s expansion of oil and gas leasing on federal lands and waters, plus reduced leasing fees, incentivizes higher fossil fuel production. In 2024, oil and gas supplied 60% of U.S. energy (31% oil, 29% gas). Increased production could boost output by 5–10%, per industry estimates, adding 50–100 million barrels of oil and 2–4 trillion cubic feet of gas annually, with a corresponding increase in pollution and environmental damage.

The bill rescinds funding for greenhouse gas reduction programs, weakening enforcement of emissions standards. Without enforcement, emissions from power plants and industrial sources could rise by 50–100 million metric tons of CO₂ annually, based on historical data when regulations were relaxed (e.g., 2017–2020 EPA rollbacks). Non-CO₂ pollutants like NOx and SO₂ could also increase, exacerbating health impacts in frontline communities.

Enjoy breathing all that new pollution in your air. (Note that Mar-a-Lago is not a “frontline community.”

Conclusion: The Big Bullshit Bill could increase U.S. pollution by 341–491 million metric tons of CO₂ annually by 2030, a 7–10% rise, plus significant increases in PM2.5, SO₂, and NOx, leading to $50–100 billion in annual health costs and 5,000–10,000 additional premature deaths over a decade. It reverses renewable energy progress, potentially reducing U.S. per capita renewable production by 300–600 kWh, while boosting per capita CO₂ emissions by 1–1.5 tons. All so the corporate oil and gas overlords can rake in more money for their shareholders and billionaire owners.

Immigrants and Asylum Seekers (Major Losers / Targeted Attacks):

New Fees: Part I of Subtitle A, Title X, introduces a wide array of new and increased immigration fees, including asylum fees, employment authorization document fees, immigration parole fees, special immigrant juvenile fees, temporary protected status fees, visa integrity fees, Form I-94 fees, annual asylum fees, and fees for renewal/extension of employment authorization for parolees, asylum applicants, and TPS aliens. There are also fees for applications for adjustment of status, Electronic System for Travel Authorization, Electronic Visa Update System, aliens ordered removed in absentia, and an inadmissible alien apprehension fee. These fees will create significant financial barriers for immigrants and asylum seekers, making it harder for them to obtain legal status, work authorization, or even apply for protection.

Increased Enforcement: The bill provides substantial appropriations for Department of Homeland Security (DHS) for "immigration and enforcement activities" , including hiring and training additional U.S. Customs and Border Protection agents, funding for transportation costs related to departure or removal of aliens, and funding for personnel assignments to carry out immigration enforcement activities. It also allocates $10,000,000,000 for fiscal year 2025 to the "State Border Security Reinforcement Fund" to assist states with border security, including "Relocation of aliens who are unlawfully present in the United States from small population centers to other domestic locations". This indicates a strong focus on increased detention, deportation, and internal enforcement, leading to more arrests and removals of immigrants.

Border Wall Funding:

Sec. 90001. Border infrastructure and wall systemallocates funds for border wall construction, which has significant environmental impacts and often fails to address root causes of migration.Sponsor Vetting for Unaccompanied Alien Children:

Sec. 87001. Potential sponsor vetting for unaccompanied alien children appropriationcould create additional hurdles for children seeking refuge and their potential sponsors.This bill in total allocates $175 billion for “immigration enforcement.” The increase in funding alone, which does not include the current spending is more than 10 times as much as the federal government spends on the school free lunch program which helps kids from going hungry.

MAGA values.

The bill proposes changes that could reduce NSLP funding by an estimated $9 billion, potentially limiting eligibility and affecting 12 million children’s access to free school meals.

The federal government spends approximately $17.2 billion annually on the National School Lunch Program (NSLP) for fiscal year 2023,. This figure covers reimbursements for free and reduced-price lunches served to eligible students, with the program providing 4.6–4.7 billion lunches in that year.

Reimbursement rates for the 2024–2025 school year are approximately $4–$4.50 per free lunch, with total costs varying based on participation and inflation adjustments. A $9 billion cut reduces the program by over 52%. For millions of children, the free or reduced school lunch is the only real meal they get each day.

Trump and MAGA do not care about starving children.Individuals Receiving Premium Tax Credits (Potential Losers / Targeted Attacks):

Sec. 71301. Permitting premium tax credit only for certain individualsandSec. 71302. Disallowing premium tax credit during periods of medicaid ineligibility due to alien status: These provisions restrict who can receive premium tax credits for health insurance, particularly targeting non-citizens, potentially making healthcare unaffordable for them.Sec. 71303. Requiring verification of eligibility for premium tax credit: This could create administrative burdens leading to people losing credits due to verification issues.Sec. 71304. Disallowing premium tax credit in case of certain coverage enrolled in during special enrollment period: This could penalize individuals who enroll during special enrollment periods, often due to life changes.These are cuts to the Affordable Care Act (i.e., Obamacare). Bottom line: more people will not have health insurance because they can’t afford it.

Long-Term Care Facilities (Potential Losers):

Sec. 71111. Moratorium on implementation of rule relating to staffing standards for long-term care facilities under the Medicare and Medicaid programs: This prevents the implementation of new staffing standards, potentially leading to lower quality of care for residents and hindering efforts to improve working conditions for staff.More cuts to senior citizens and Medicare.

Students (Potential Losers):

Sec. 81001. Establishment of loan limits for graduate and professional students and parent borrowers; termination of graduate and professional PLUS loans: This directly restricts access to federal loans for graduate and professional education, potentially making it much harder for students from less affluent backgrounds to pursue advanced degrees.Subtitle C—Loan Repaymentsections could be problematic depending on the specific changes to loan repayment, deferment, forbearance, loan rehabilitation, and public service loan forgiveness. Any tightening of these provisions would negatively impact borrowers struggling with student debt.Sec. 84001. Ineligibility based on low earning outcomes: This could lead to students being deemed ineligible for federal aid if their chosen programs do not lead to certain earning outcomes, potentially limiting educational choices, particularly for those in fields with lower immediate earning potential but high societal value.Sec. 70606. Social security number requirement for American Opportunity and Lifetime Learning credits: While seemingly administrative, this could create hurdles for individuals without an SSN to claim these education tax credits.These cuts essentially make it more difficult for young adults to go to college as they slash student loan funding. Dumb Americans are a long-term goal of MAGA elites because dumb people are more susceptible to theiri propaganda.

3. Pork and Carveouts

I asked Gemini to identify provisions which are likely to be pork inserted to buy a legislator’s vote. While some are obvious, like Alaska Senator Lisa Murkowski’s bribe, for the most part Gemini did not do a great job at tying the giveaways to specific Senators. Nevertheless, here are some examples of seemingly random payouts (“dye fuel?”).

Identifying specific "pork" or carveouts without external information is challenging, as such provisions are often designed to appear broadly beneficial while subtly favoring specific interests or regions. However, based purely on the text, some sections could be interpreted as such:

Sec. 70428. Nonprofit community development activities in remote native villages.

: While framed as community development, the specific targeting of "remote native villages" could be a carveout intended to benefit specific communities or a legislator representing those areas.

Sec. 70429. Adjustment of charitable deduction for certain expenses incurred in support of Native Alaskan subsistence whaling.

: This is a very specific charitable deduction, strongly suggesting a carveout designed to benefit a particular cultural practice and potentially the Alaskan delegation.

Sec. 70525. Allow for payments to certain individuals who dye fuel.

: This is a highly specific provision that could benefit a niche industry or a legislator connected to it.

Sec. 70204. Trump accounts and contribution pilot program.

: The naming of this program directly after the former President suggests a symbolic, if not directly financial, carveout for a political agenda.

Sec. 86001. Garden of Heroes.

: This section, appearing within a bill focused on health, education, labor, and pensions, seems like a non-germane appropriation that could be a specific project benefiting a particular location or a legislator's pet project.

Sec. 90006. Presidential residence protection.

: The appropriation of $300,000,000 for fiscal year 2025 for "reimbursement of extraordinary law enforcement personnel costs for protection activities directly and demonstrably associated with" presidential residences seems like a significant and specific allocation that could be considered a carveout for the sitting president or future presidents, and indirectly, the security services involved.

Sec. 70309. Spaceports are treated like airports under exempt facility bond rules.

: This change in tax law benefits the nascent space industry by making it easier to finance spaceport construction, potentially a carveout for states with existing or planned space launch facilities.

4. Targeted Attacks

Immigrants and Asylum Seekers: As detailed above, the numerous new fees for immigration applications and documents , coupled with significant funding for enhanced border security and internal enforcement, including relocation of unlawfully present aliens, clearly constitute a targeted attack on this population. The effect will be reduced legal immigration, increased deportations, and greater hardship for those seeking asylum or a new life in the U.S.

Low-Income Individuals and Families:

The modifications to SNAP work requirements and alien SNAP eligibility directly target individuals and families reliant on food assistance.

The changes to Medicaid eligibility, including for non-citizens and the introduction of community engagement requirements and increased cost-sharing, disproportionately affect low-income individuals, potentially leading to a loss of health insurance and access to care.

The disallowing of premium tax credits for certain individuals and during periods of Medicaid ineligibility due to alien status also targets low-income and non-citizen populations, making healthcare less accessible.

Environmental Protections and Climate Initiatives: The widespread termination and restriction of clean energy tax credits and the rescission of funds for various environmental protection programs represent a targeted attack on efforts to combat climate change and reduce pollution. The effect will be a slowdown, if not reversal, of progress in these areas, potentially leading to increased greenhouse gas emissions and environmental degradation.

Women (Indirectly through "Prohibited Entities"): While not explicitly stated, the provision

Sec. 71113. Federal payments to prohibited entitiesis a common legislative tactic used to defund organizations like Planned Parenthood, which provide critical reproductive healthcare services, including abortion and contraception, as well as broader primary care. This would disproportionately affect women, particularly those in rural or underserved areas who rely on such clinics."Blue" States/Urban Areas (Potential Indirect Attack): The significant rescissions of funding for programs like "Neighborhood Access and Equity Grant Program" and potential impacts from limitations on state and local tax deductions, could disproportionately affect urban areas and states with more progressive environmental and social programs, often associated with Democratic governance. While not explicitly stated, this could be an indirect effect.

5. Tax Effects

Billionaires and Millionaires (Potential Tax Cuts):

Estate and Gift Tax Exemption: The bill includes an "extension and enhancement of increased estate and gift tax exemption amounts." This change primarily benefits the wealthiest individuals and families by allowing them to transfer more assets without incurring estate or gift taxes, effectively reducing their potential tax liability.

Alternative Minimum Tax (AMT) Exemption: "Extension and enhancement of increased alternative minimum tax exemption amounts and modification of phaseout thresholds" would also primarily benefit high-income earners by reducing their AMT obligations.

Business-Related Provisions: Changes like "full expensing for business property and domestic research and experimental expenditures," "modification of business interest limitation," and various international tax reforms (e.g., related to foreign tax credit, foreign-derived deduction eligible income) are likely to result in significant tax advantages for large corporations and businesses. The benefits of these provisions would largely accrue to their owners and top executives, who often fall into the millionaire and billionaire categories.

Spaceports as Airports for Exempt Facility Bonds: Treating spaceports like airports for exempt facility bond rules benefits investors in the space industry, often high-net-worth individuals or corporations.

Middle Class (Mixed Impact – Potential Tax Cuts for Some, Potential Increases for Others):

"Permanent Tax Relief for Middle-Class Families and Workers": The bill purports to provide this through "extension and enhancement of reduced rates," "increased standard deduction," and "increased child tax credit." These measures are generally designed to reduce the tax burden for many middle-income households.

"New Middle-Class Tax Relief": Explicit mentions of "no tax on tips," "no tax on overtime," and "no tax on car loan interest" are framed as benefits for the middle class.

Child Care and Education Credits: Enhancements to the employer-provided child care credit, adoption credit, and child and dependent care tax credit, along with an exclusion for employer payments of student loans, could provide tax relief to qualifying middle-class families.

Clean Energy Tax Credit Terminations (Potential Tax Increases for Some): The bill explicitly terminates several clean energy tax credits (e.g., clean vehicle, energy efficient home improvement, residential clean energy). Middle-class individuals who had planned to purchase electric vehicles or invest in home energy efficiency improvements would lose these tax incentives, effectively facing a higher cost or tax burden than under previous law.

Poor (Potential Tax Increases / Loss of Benefits):

Premium Tax Credit Limitations: The bill restricts who can receive premium tax credits for health insurance, particularly disallowing them during periods of Medicaid ineligibility due to alien status and for certain coverage enrolled in during special enrollment periods. This could lead to higher healthcare costs or a complete loss of affordable health insurance for low-income individuals, especially non-citizens.

Social Security Number Requirement for Education Credits: The requirement for a social security number for American Opportunity and Lifetime Learning credits could create hurdles for some low-income individuals or families, potentially preventing them from claiming these educational tax benefits.

Ending Unemployment Payments to Jobless Millionaires: While this targets high-income individuals, it is an example of a specific benefit being removed. The bill does not outline corresponding new or expanded tax benefits specifically for the poor to offset other potential losses from reductions in social programs.

In summary, the bill's tax provisions generally appear to favor high-income individuals and businesses through direct tax reductions and incentives, while offering some targeted relief for middle-class families. However, the termination of certain clean energy credits and restrictions on healthcare premium tax credits could negatively impact segments of the middle and lower-income populations. The bill does not contain the specific numerical breakdowns requested

Conclusion

In conclusion, H.R. 1 appears to systematically dismantle social safety nets, curtail environmental protections, and tighten immigration controls, while simultaneously providing significant tax relief and benefits to specific industries and higher-income individuals. The bill's emphasis on "America-First Energy Policy" and increased defense spending suggests a shift in national priorities that could have profound impacts on the well-being of vulnerable populations and the nation's environmental future.

GOP politicians are universally cowards and this bill is almost certain to pass in the House. Nevertheless, please call your U.S. House representative (202-224-3121) and tell them to vote no, especially if you live in a red state. Thousands of people are going to suffer or die form lack of health care, from increased pollution and from lack of food.

MAGA values are not American values!

Support GOP Jesus's work. Share and follow gopjesus.bsky.social on Bluesky, and @GOPJesusUSA on X, Instagram, YouTube and Threads.

I can’t do this alone. For merch and to donate, visit my website: gop-jesus.com. Become a paying subscriber to get the latest posts first, and DM me to volunteer or help out.

☮️ Peace ☮️